Sustainability

World must triple clean energy investment by 2030 to curb climate change -IEA

Source: Reuters

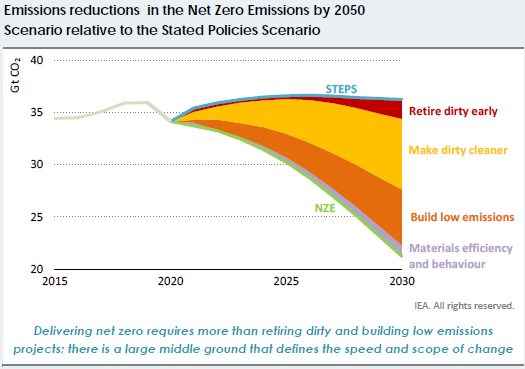

LONDON, Oct 13 (Reuters) – Investment in renewable energy needs to triple by the end of the decade if the world hopes to effectively fight climate change and keep volatile energy markets under control, the International Energy Agency (IEA) said on Wednesday.

“The world is not investing enough to meet its future energy needs … transition‐related spending is gradually picking up, but remains far short of what is required to meet rising demand for energy services in a sustainable way,” the IEA said.

“Clear signals and direction from policy makers are essential. If the road ahead is paved only with good intentions, then it will be a bumpy ride indeed,” it added.

The Paris-based watchdog released its annual World Energy Outlook early this year to guide the United Nations COP26 climate change conference, now less than a month away. read more

It called the Glasgow, Scotland meeting the “first test of the readiness of countries to submit new and more ambitious commitments under the 2015 Paris Agreement” and “an opportunity to provide an ‘unmistakeable signal’ that accelerates the transition to clean energy worldwide.”

In recent weeks, power prices surged to record levels as oil and natural gas prices hit multi-year highs and widespread energy shortages engulfed Asia, Europe and the United States. Fossil fuel demand is also recovering as governments ease curbs to contain the spread of COVID-19. read more

The IEA warned that renewables like solar, wind and hydropower along with bioenergy need to form a far bigger share in the rebound in energy investment after the pandemic.

Renewables will account for more than two-thirds of investment in new power capacity this year, the IEA noted, yet a sizeable gain in coal and oil use have caused the second largest annual increase in climate change-causing CO2 emissions.

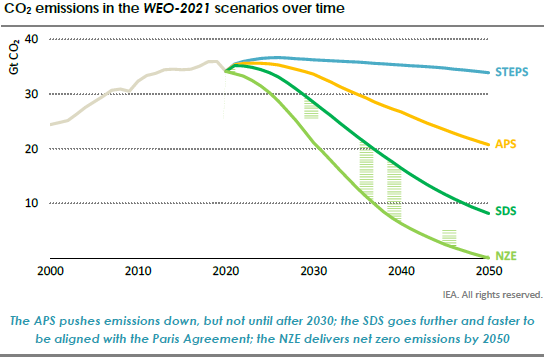

The IEA said a faster energy transition will better shield consumers in the future, because a commodity price shock would drive up costs for households 30% less in its most ambitious Net Zero Emissions by 2050 (NZE) scenario versus in its more conservative Stated Policies Scenario (STEPS).

STATUS QUO VERSUS NET ZERO

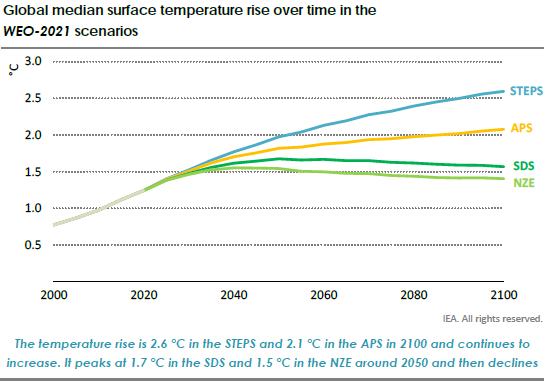

Still, the leap necessary to make good on pledges in the 2015 Paris Agreement to cap the rise in temperatures to as close as possible to 1.5 degrees Celsius above pre-industrial times remains vast.

Fossil fuels coal, natural gas and oil made up nearly 80% of world energy supply in 2020 and renewables just 12%.

To keep that rise near 1.5 degrees, the IEA’s NZE prediction envisions those fossil fuels shrinking to just under a quarter of the mid-century supply mix and renewables skyrocketing to just over two-thirds.

If the world stays on its current track outlined by STEPS scenario, temperatures will jump 2.6 degrees Celsius by 2100.

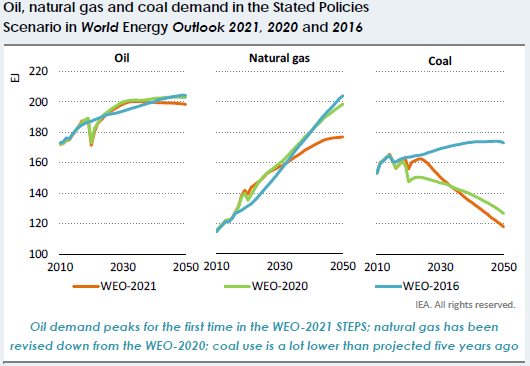

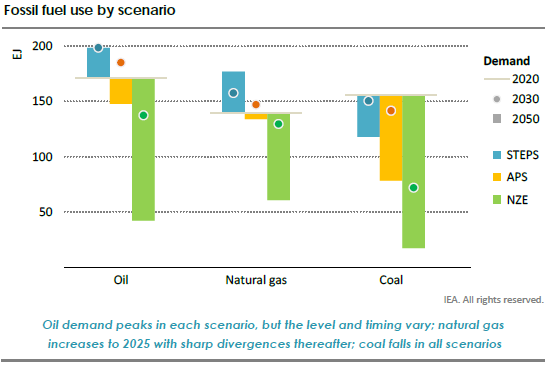

The IEA foresees a peak to oil demand in all its scenarios for the first time, in the mid‐2030s in the STEPS forecast with a very gradual decline but in the NZE forecast plateauing within a decade and dropping further by nearly three-quarters by 2050. read more

Doubling down on the agency’s starkest warning yet on the future of fossil fuels that it made in a May report, the IEA said its NZE picture envisioned lower demand and a rise in low emissions fuels making new oil and gas fields beyond 2021 unnecessary. read more

However, it did say new oil fields would be required in its two most conservative scenarios and provided tips on mitigating their climate impact like reducing methane flaring.

“Every data point showing the speed of change in energy can be countered by another showing the stubbornness of the status quo,” the IEA warned.

“Today’s energy system is not capable of meeting these challenges; a low emissions revolution is long overdue.”

Reporting by Noah Browning; Editing by David Gregorio

Our Standards: The Thomson Reuters Trust Principles.

You may like

Auto

The Benefits of EV Salary Sacrifice: A Guide for Employers and Employees

As the UK government continues to push for greener initiatives, electric cars have become increasingly popular. The main attraction for both employers and employees is the EV salary sacrifice scheme.

By participating in an EV salary sacrifice scheme, both employers and employees can enjoy cost savings and contribute to environmental sustainability along the way! This article will delve into the specifics of how these schemes operate, the financial advantages they offer, and the broader positive impacts on sustainability.

We will provide a comprehensive overview of the mechanics behind EV salary sacrifice schemes and discuss the various ways in which they benefit both employees and employers, ultimately supporting the transition to a greener future in the UK.

What is an EV Salary Sacrifice Scheme?

An EV salary sacrifice scheme is a flexible financial arrangement that permits employees to lease an EV through their employer. The key feature of this scheme is that the leasing cost is deducted directly from the employee’s gross salary before tax and National Insurance contributions are applied. By reducing the taxable income, employees can benefit from substantial savings on both tax and National Insurance payments. This arrangement not only makes EVs more affordable for employees but also aligns with governmental incentives to reduce carbon emissions.

For employers, implementing an EV salary sacrifice scheme can lead to cost efficiencies as well. The reduction in National Insurance contributions on the employee’s reduced gross salary can offset some of the costs associated with administering the scheme. Additionally, such programmes can enhance the overall benefits package offered by the employer, making the company more attractive to prospective and current employees.

Benefits for Employees

1. Tax and National Insurance Savings

By opting for an EV salary sacrifice scheme, employees can benefit from reduced tax and National Insurance contributions. Since the lease payments are made from the gross salary, the taxable income decreases, resulting in substantial savings.

2. Access to Premium EVs

Leading salary sacrifice car schemes often provide access to high-end electric vehicles that might be otherwise unaffordable. Employees can enjoy the latest EV models with advanced features, contributing to a more enjoyable and environmentally friendly driving experience.

3. Lower Running Costs

Electric vehicles typically have lower running costs compared to traditional petrol or diesel cars. With savings on fuel, reduced maintenance costs, and exemptions from certain charges (such as London’s Congestion Charge), employees can enjoy significant long-term financial benefits.

4. Environmental Impact

Driving an electric vehicle reduces the carbon footprint and supports the UK’s goal of achieving net-zero emissions by 2050. Employees can take pride in contributing to a cleaner environment.

Benefits for Employers

1. Attract and Retain Talent

Offering an EV salary sacrifice scheme can enhance an employer’s benefits package, making it more attractive to potential recruits. It also helps in retaining current employees by providing them with valuable and cost-effective benefits.

2. Cost Neutrality

For employers, EV salary sacrifice schemes are often cost-neutral. The savings on National Insurance contributions can offset the administrative costs of running the scheme, making it an economically viable option.

3. Corporate Social Responsibility (CSR)

Implementing an EV salary sacrifice scheme demonstrates a commitment to sustainability and corporate social responsibility. This can improve the company’s public image and align with broader environmental goals.

4. Employee Well-being

Providing employees with a cost-effective means to drive electric vehicles can contribute to their overall well-being. With lower running costs and the convenience of driving a new EV, employees may experience reduced financial stress and increased job satisfaction.

How to Implement an EV Salary Sacrifice Scheme

1. Assess Feasibility

Evaluate whether an EV salary sacrifice scheme is feasible for your organisation. Consider the number of interested employees, potential cost savings, and administrative requirements.

2. Choose a Provider

Select a reputable provider that offers a range of electric vehicles and comprehensive support services. Ensure they can handle the administrative tasks and provide a seamless experience for both the employer and employees.

3. Communicate the Benefits

Educate your employees about the advantages of the scheme. Highlight the financial savings, environmental impact, and access to premium EV models. Provide clear guidance on how they can participate in the programme.

4. Monitor and Review

Regularly review the scheme’s performance to ensure it continues to meet the needs of your employees and the organisation. Gather feedback and make adjustments as necessary to enhance the programme’s effectiveness.

Conclusion

The EV salary sacrifice scheme offers a win-win situation for both employers and employees in the UK. With significant financial savings, access to premium vehicles, and a positive environmental impact, it’s an attractive option for forward-thinking organisations. By implementing such a scheme, employers can demonstrate their commitment to sustainability and employee well-being, while employees can enjoy the benefits of driving an electric vehicle at a reduced cost.

Adopting an EV salary sacrifice scheme is a step towards a greener, more sustainable future for everyone.

Business

A journey into the heart of sustainable practices

By Rosemary Thomas, Senior Technical Researcher, AI Labs, Version 1

Artificial Intelligence is a transformative force that is reshaping our daily lives. It serves as an instrument of change, driving innovation across various sectors by automating tasks, providing insightful data analysis, and enabling new forms of interaction. AI is fostering a new era of efficiency, productivity, and creativity.

More importantly though, through transparency, ethical AI practices, and healthy privacy safeguards, AI can help to strengthen our trust in technology and its role in our daily lives. It is a catalyst for changing how society perceives sustainability, helping us predict and work towards a more sustainable, ethical future.

Making a difference with AI for good

‘AI for good’ pertains to the use of AI technologies to help solve specific societal challenges and contribute towards making people’s lives better. It leverages the strength of AI to address issues like economic hardship, physical and mental wellbeing, academic achievement, and the preservation of nature.

For businesses, ‘AI for good’ can mean using AI to contribute towards environmental, social, and governance (ESG). Used correctly, AI can help to create sustainable strategies, powering solutions that present a greater advantage to society. It can also help with ESG reporting, which has become a highly time-consuming process involving data collection, the use of multiple frameworks, rapidly changing disclosure requirements, the integration of different models, reporting, and data analysis. By adding AI capabilities into this process, businesses can streamline their operations, increase data accuracy, and increase confidence in stakeholder engagement.

A recent example of an ‘AI for good’ application is the TNMOC Mate designed for The National Museum of Computing. The app offers a different experience, tailored to each guest meaning neurodiverse and non-English speaking individuals, as well as young children, can engage with the museum exhibits equally. This is a prime example of AI being used to bring societal advantage, helping people regardless of their background or abilities to enjoy the museum experience as intended, by using generative AI to present complex exhibit information in a way that is easily understandable.

Improving sustainability with green AI

Green AI is another aspect of ‘AI for good’. It relates to eco-friendly artificial intelligence algorithms, models or systems that use less computational power and emit lower carbon. It holds significant importance, given that a call for a thorough review of sustainability has arisen since Large Language Models (LLMs) have been criticised for their large carbon footprints and energy usage.

One way of implementing Green AI, is leveraging AI systems for efficient inventory and resource management. Machine Learning models can analyse the performance data of equipment and devices, then use this data to help extend the lifespan of resources and ensure their optimal utilisation. They can also schedule updates, hardware upgrades and maintenance proactively, avoiding potential downtime. Furthermore, these models can detect abnormalities in system operations early, allowing organisations to conduct timely maintenance. This can help them save time and money, as well as reducing wastage.

AI models also play a crucial role in computing and energy efficiency. They can analyse and optimise energy consumption patterns, leading to significant improvements in operational efficiency.

Additionally, while LLMs can contribute to carbon emissions, they can also serve as a powerful tool in battling climate change. LLMs can expedite research and innovation processes while maintaining a focus on sustainability. By generating creative and diverse solutions, they can help organisations stay at the forefront of their industries, while keeping sustainability at the core of their operations.

Measure more than carbon footprint in AI metrics

It is no doubt important to measure carbon emissions during the training of models. It can prove crucial when considering regional differences, as this plays a key role in promoting sustainability. But given the wide range of energy efficiency measurements across different AI algorithms, it is essential to include additional energy metrics along with traditional performance indicators. Choosing cloud providers that prioritise eco-friendliness is recommended, as well as strategically selecting the locations of data centres; the ultimate aim should be to foster the creation of AI solutions that are not only energy-efficient, but also environmentally friendly.

There is a call to standardise energy and carbon data reporting, which has been seen as a step towards encouraging social responsibility in the field of AI research and development. However, reporting cannot be done without accurate calculations, and carbon measurement is still in its early stages. When calculating the carbon footprint of a model, we should consider all variables equally, not just the final value of carbon. This is fundamental because, without this knowledge, we are ill-equipped to manage or improve it.

Fortunately, there are organisations working to solve this challenge. For example, The Green Software Foundation (GSF) is a non-profit organisation that aims to create a trusted ecosystem of people, standards, and best practices for developing green software and AI. The GSF have various tools and methods to help us measure and reduce the environmental impact such as the ‘Impact Framework’,‘Software Carbon Intensity’ (SCI) specification, and the Green Software Maturity Matrix[1].

Inclusion and diversity in the ethical use of AI

Safeguarding ethical use involves laying the groundwork for ethical standards, tackling biases in AI systems, prioritising transparency and explainability, and protecting against privacy concerns. The impact on human autonomy and responsibility gaps must also be contemplated, along with calculating the financial and environmental costs of training deep learning models.

There are implications arising from both responsible and irresponsible AI deployment, and it is important to illustrate examples of both sides in AI applications. In healthcare, for example, AI systems are used to assist medical professionals in transparent diagnosis and accountable treatment planning. This boosts patient care, promotes fair and informed decision-making, and contributes to better health outcomes.

In human resources, AI can be used for unbiased staffing processes. It moderates human biases, elevates inclusion and diversity, and promotes evenly balanced opportunities for all candidates.

Finally, in environmental monitoring, AI is used for the transparent monitoring and managing of eco-friendly dynamics, such as air and water quality, using sensors, transmitters, and data analytics. This helps to care for the environment, protect ecosystems and support the well-being of groups by addressing environmental hazards.

The non-ethical use of AI is more prevalent in surveillance systems, especially with facial recognition deployed in public spaces. This technology is used for mass surveillance, tracing individuals without their consent, and disregarding privacy rights, and in the US in particular this can be easily misused. AI tools can also be used in the creation of deepfakes to create dangerous misinformation.

Additionally, if the training data consists of historical biases, AI systems can spread and increase prejudice – resulting in unjust treatment which can excessively impact certain demographic communities. Finally, social engineering attacks using AI systems can be much more difficult to detect, and prompt injection attacks and LLM poisoning can intentionally cause harm and malice for a larger population.

Ethical, sustainable AI

As we collectively strive towards a sustainable future, AI is emerging as a key driving force. It is steering us towards solutions that are not only economically viable, but also environmentally sound and socially responsible.

Organisations should start to leverage sustainable AI, making sure that these technologies are having a positive impact of the ESG commitments, while ensuring they are created and used in a way that is ethical, fair, and transparent. In this journey, every algorithm we design, every model we train, and every AI-powered solution we deploy can take us one step closer to our goal of sustainability.

[1] https://medium.com/version-1/what-really-matters-for-green-calculations-a-practical-perspective-0bc0f5c7540c

Auto

Could electric vehicles be the answer to energy flexibility?

Rolf Bienert, Managing and Technical Director, OpenADR Alliance

Last year, what was the Department for Business, Energy & Industrial Strategy and Ofgem published its Electric Vehicle Smart Charging Action plans to unlock the power of electric vehicle (EV) charging. Owners would have the opportunity to charge their vehicles while powering their homes with excess electricity stored in their car.

Known as vehicle to grid (V2G) or vehicle to everything (V2X), it is the communication between a vehicle and another entity. This could be the transfer of electricity stored in an EV to the home, the grid, or to other destinations. V2X requires bi-directional energy flow from the charger to the vehicle and bi- or unidirectional flow from the charger to the destination, depending on how it is being used.

While there are V2X pilots already out there, it’s considered an emerging technology. The Government is backing it with its V2X Innovation Programme with the aim of addressing barriers to enabling energy flexibility from EV charging. Phase 1 will support development of V2X bi-directional charging prototype hardware, software or business models, while phase 2 will support small scale V2X demonstrations.

The programme is part of the Flexibility Innovation Programme which looks to enable large-scale widespread electricity system flexibility through smart, flexible, secure, and accessible technologies – and will fund innovation across a range of key smart energy applications.

As part of the initiative, the Government will also fund Demand Side Response (DSR) projects activated through both the Innovation Programme and its Interoperable Demand Side Response Programme (IDSR) designed to support innovation and design of IDSR systems. DSR and energy flexibility is becoming increasingly important as demand for energy grows.

The EV potential

EVs offer a potential energy resource, especially at peak times when the electricity grid is under pressure. Designed to power cars weighing two tonnes or more, EV batteries are large, especially when compared to other potential energy resources.

While a typical solar system for the home is around 10kWh, electric car batteries range from 30kWh or more. A Jaguar i-Pace is 85kWh while the Tesla model S has a 100kWh battery, which offers a much larger resource. This means that a fully powered EV could support an average home for several days.

But to make this a reality the technology needs to be in place first to ensure there is a stable, reliable and secure supply of power. Most EV charging systems are already connected via apps and control platforms with pre-set systems, so easy to access and easy to use. But, owners will need to factor in possible additional hardware costs, including invertors for charging and discharging the power.

The vehicle owner must also have control over what they want to do. For example, how much of the charge from the car battery they want to make available to the grid and how much they want to leave in the vehicle.

The concept of bi-directional charging means that vehicles need to be designed with bi-directional power flow in mind and Electric Vehicle Supply Equipment will have to be upgraded as Electric Vehicle Power Exchange Equipment (EVPE).

Critical success factors

Open standards will be also critical to the success of this opportunity, and to ensure the charging infrastructure for V2X and V2G use cases is fit for purpose.

There are also lifecycle implications for the battery that need to be addressed as bi-directional charging can lead to degradation and shortening of battery life. Typically EVs are sold with an eight-year battery life, but this depends on the model, so drivers might be reluctant to add extra wear and tear, or pay for new batteries before time.

There is also the question of power quality. With more and more high-powered invertors pushing power into the grid, it could lead to questions about power quality that is not up to standard, and that may require periodic grid code adjustments.

But before this becomes reality, it has to be something that EV owners want. The industry is looking to educate users about the benefits and opportunities of V2X, but is it enough? We need a unified message, from automotive companies and OEMs, to government, and a concerted effort to promote new smart energy initiatives.

While plans are not yet agreed with regards to a ban on the sale on new petrol and diesel vehicles, figures from the IEA show that by 2035, one in four vehicles on the road will be electric. So, it’s time to raise awareness the opportunities of these programs.

With trials already happening in the UK, US, and other markets, I’m optimistic that it could become a disruptor market for this technology.

Stealthy Malware: How Does it Work and How Should Enterprises Mitigate It?

How 5G and AI shaping the future of eHealth

Driving business success in today’s data-driven world through data governance

The Sustainability Carrot Could be More Powerful Than the Stick!

Hybrid cloud adoption: why vendors are making the switch in 2022 and why you should too